Key Findings

- Fewer than half of people age 50 and older (43%) think it is likely they will need long-term care in the future.

- 48% of older adults say they do not know how to plan for their long-term care needs.

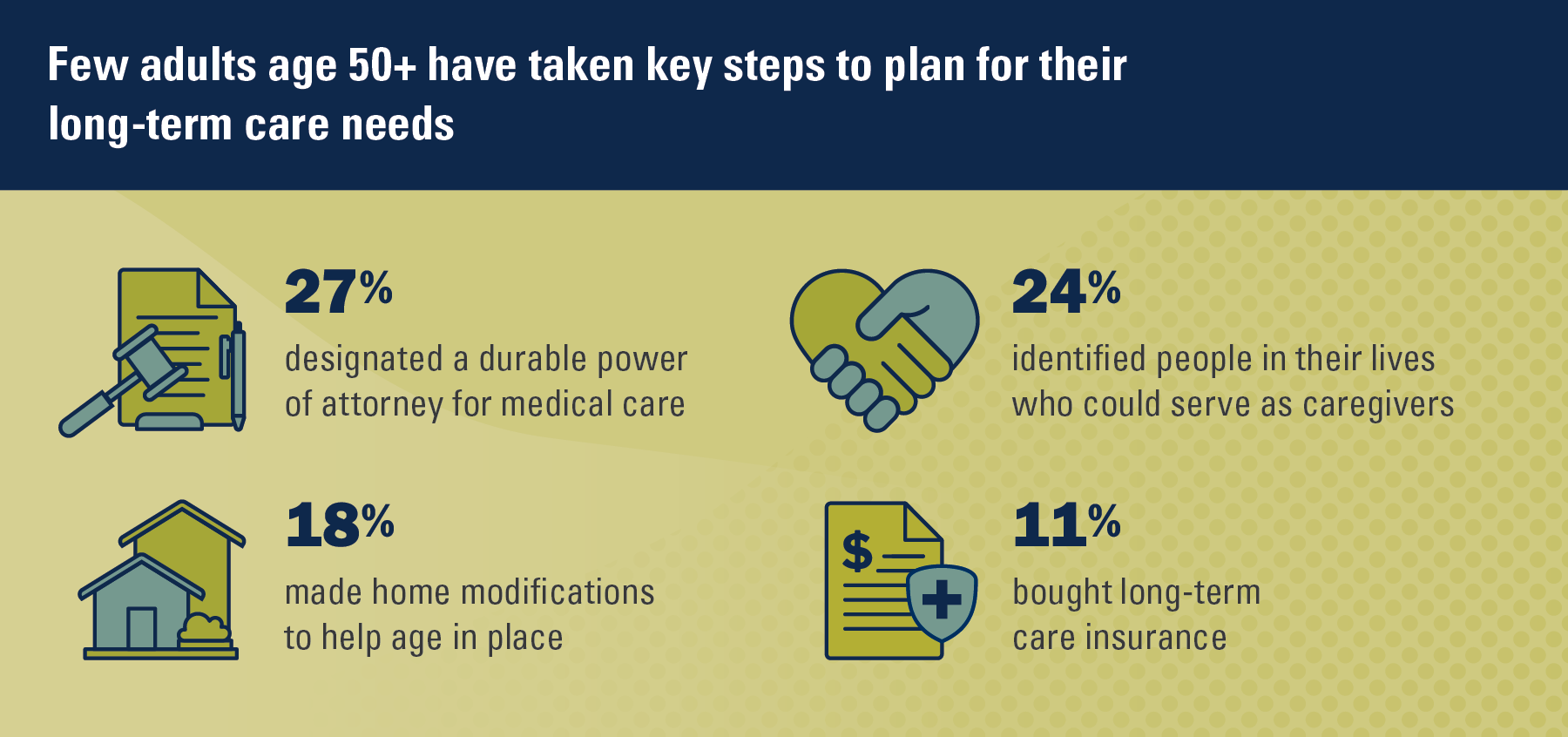

- Few older adults have taken key steps to prepare for long-term care needs, including designating a durable power of attorney for medical care (27%) and identifying people in their lives who could serve as caregivers (24%).

- 62% of adults age 50 and older mistakenly think Medicare will pay for their care if they need to permanently move into a nursing home.

Long-term care services help meet health and personal care needs like bathing, dressing, and eating when a person can no longer perform them independently. In August 2024, the University of Michigan National Poll on Healthy Aging asked a national sample of adults age 50 and older about their experiences with and views on planning and preferences for long-term care.

Preparing and planning for long-term care

Expectations and worry around needing care

Fewer than half of people age 50 and older (43%) believed it was likely they would need long-term care (home care, assisted living, or nursing home care) in the future, while 57% thought it was unlikely. Older adults who reported having a health problem or disability that limits their daily activities were more likely to think they will need long-term care in the future than those without such limitations (57% vs. 34%). Overall, adults age 65 and older were more likely than those age 50-64 to think they will need long-term care in the future (45% vs. 40%).

Moreover, 48% of older adults said they were worried about their future needs for long-term care, while 52% were not worried. Older adults who reported having a health problem or disability that limits their daily activities were more likely than those without such limitations to express worry about their future need for long-term care (58% vs. 41%).

In all, 45% of people age 50 and older said their need for long-term care seems too far off to make plans for it.

Taking action

When asked about specific ways they may have planned for their future long-term care needs, some adults age 50 and older reported that they:

- Designated a durable power of attorney for medical care (27%)

- Identified people in their lives who could serve as caregivers (24%)

- Made home modifications to help age in place (18%)

- Bought long-term care insurance (11%)

- Looked into or visited assisted living / nursing home facilities (7%)

In all, 50% reported taking one or more of the above steps. Making plans for future long-term care needs varied by age, with 65% of adults age 65 and older saying they have taken at least one of the above steps to plan for their future long-term care needs, as compared to 37% of adults age 50-64.

Among adults age 50 and older, 52% said they know how to plan for their long-term care needs, and 48% said they do not know how to do so. Adults with fair or poor physical health or mental health were less likely to say they know how to plan for their long-term care needs than those with excellent, very good, or good physical health or mental health.

Discussing long-term care plans with others

About half of people age 50 and older (52%) said they have discussed their long-term care plans / options with at least one of the following people:

- A spouse / partner (33%)

- Children (30%)

- A close friend (10%)

- Other relative (9%)

- A health care provider (5%)

- Grandchildren (4%)

Adults age 65 and older were more likely than those age 50-64 to have discussed their long-term care plans with someone (66% vs. 41%).

Paying for long-term care

The majority of people age 50 and older said they are not confident they can pay for nursing home (62%), assisted living (58%), or home care (51%).

When asked who they thought would pay for their care if they needed to permanently move into a nursing home, older adults reported they expected that their care would be paid for by the following sources:

- Medicare (62%)

- Personal financial resources (theirs or their family’s) (50%)

- Medicaid (29%)

- Long-term care insurance (19%)

Care preferences and decision-making

If they needed support with daily activities in the future, adults age 50 and older reported that their most preferred setting to receive long-term care services would be:

- their home with family / friend caregivers (52%)

- their home with paid caregivers (21%)

- their home without help (14%)

- an assisted living facility (6%)

- the home of a family member / friend caregiver (6%)

- a nursing home (1%)

Some older adults (39%) said they will let their family make decisions about their long-term care for them, whereas the majority (61%) indicated that they will not let their family make these decisions on their behalf.

Impressions of long-term care

Assisted living

In all, 41% of people age 50 and older said they have a mostly positive overall impression of assisted living, while 25% have a mostly negative overall impression, and 33% were unsure.

Nursing homes

Overall, 13% of people age 50 and older said they have a mostly positive overall impression of nursing homes, while 59% said they have a mostly negative overall impression, and 27% were unsure.

When asked about nursing homes specifically, many older adults indicated the following concerns:

- Quality of care (overall care and safety) (81%)

- Cost (77%)

- Quality of life (such as comfort of facility, activities) (71%)

- Staffing (64%)

- Spread of infections (60%)

- Boredom / loneliness (54%)

- Medication errors (42%)

Implications

This poll found that many older adults in the U.S. do not think they will need long-term care, and many have not taken steps to plan for future long-term care needs. Overall, only 45% of adults age 65 and older believe they will likely need long-term care in the future, whereas national statistics suggest that many more will actually use it.

Relatedly, this poll highlights major gaps in planning and preparedness for long-term care among adults age 50 and older. Many people in this age group felt the need for long-term care is too far off to plan for it, and nearly half reported they do not know how to plan. Meanwhile, only half of older adults have discussed their long-term care options with anyone.

Additionally, most adults age 50 and older believe that Medicare will pay for care if they need to permanently move into a nursing home, but Medicare generally does not cover long-term care in a nursing home. Nursing home care is commonly paid for by Medicaid or private sources, including personal and family savings. Public education efforts could help more older adults know how to plan for long-term care needs, take meaningful planning steps, and identify feasible ways to finance long-term care services.

The majority of older adults would prefer to remain in their home with the support of caregivers if they needed help with daily activities. A much smaller percentage preferred to receive care in assisted living and very few would prefer to receive long-term care in a nursing home. These preferences could be driven in part by the concerns that many reported about nursing homes, ranging from the quality of care, to the costs, to boredom and loneliness.

Furthermore, older adults felt more confident about being able to pay for care in their home versus in a nursing home. However, when thinking about home care, it is important to consider the high costs of long-term care services provided in home by paid caregivers, or the often hidden, yet substantial, non-financial costs of unpaid care provided by family members and friends. Having planning conversations with family and friends could provide vital opportunities to make living in one’s home while receiving long-term care services more feasible.

Older adults with a health problem or disability were more likely than others to think they will need long-term care. Adults age 65 and older were more likely than those age 50-64 to have spoken to someone else about their long-term care plans and to have taken some action to plan for eventual needs. Yet, one-third of adults age 65 and older have not discussed their long-term care plans with anyone. Further, older adults in fair or poor physical or mental health were less confident about how to plan for long-term care needs, highlighting the importance of targeted outreach and assistance for those who may have greater needs for long-term care services in the future.

Taken together, these findings point to the critical importance of educating and helping older adults prepare for their future long-term care needs. Policymakers can help raise awareness about the importance of long-term care planning and the resources that are available. Additionally, organizations like Area Agencies on Aging, a nationwide network of organizations that provide services and resources to older adults and their families in their local areas, along with professionals such as financial planners, elder law attorneys, and geriatric care managers, can assist older adults and their families in understanding their long-term care options and developing personalized long-term care plans. Older adults and their families can take proactive steps, like connecting with these organizations and professionals, to develop long-term care plans to ensure access to essential supports and services when they need them, help maximize independence and quality of life, and limit the financial impacts of long-term care.

Data Source and Methods

This National Poll on Healthy Aging report presents findings from a national household survey conducted exclusively by NORC at the University of Chicago for the University of Michigan’s Institute for Healthcare Policy and Innovation. This survey module was administered online and by phone from August 5th – 27th, 2024, to a randomly selected, stratified group of U.S. adults age 50–94 (n=3,486), with an oversample of non-Hispanic Black, Hispanic, and Asian American and Pacific Islander populations. The survey completion rate was 36% among panel members invited to participate. The margin of error is +/– 1 to 4 percentage points for questions asked of the full sample and higher among subgroups.

Findings from the National Poll on Healthy Aging do not represent the opinions of the University of Michigan. The University of Michigan reserves all rights over this material.

Read other National Poll on Healthy Aging reports and about our Michigan findings, and learn about the poll methodology.

For interactive data tables, see https://michmed.org/ygq7G

Citation

National Poll on Healthy Aging Team. Long-Term Care: Are Older Adults Ready? University of Michigan National Poll on Healthy Aging. May/June 2025. Available at https://dx.doi.org/10.7302/25443