National Key Findings

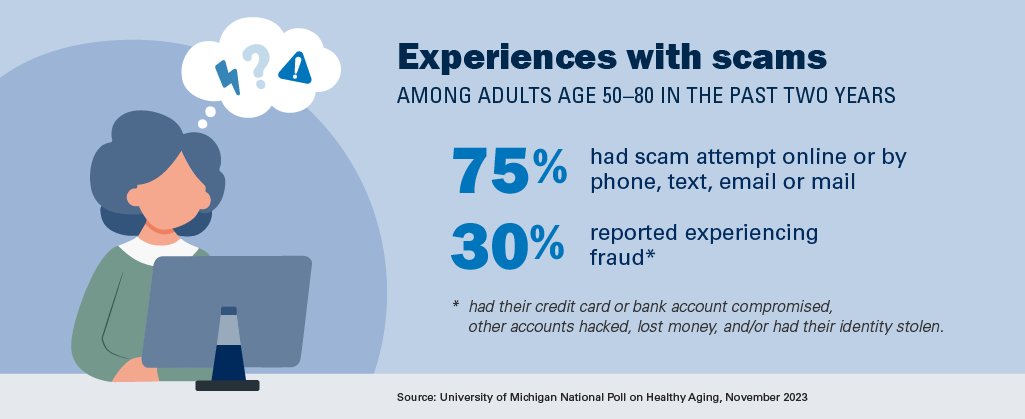

In the past two years, 75% of adults age 50-80 reported experiencing a scam attempt and 30% experienced fraud.

Older adults in worse mental or physical health are more likely to be the target of a scam and have a fraud experience compared with those in better health.

Overall, 83% of all older adults want to know more about how to protect themselves from scams and nearly all believe policymakers and companies should do a better job protecting people from scams.

Scams are fraudulent schemes that take something of value and can include government impersonation, deceitful sweepstakes, and investment scams. Among older adults, fraud from scams results in more than $1 billion in individual losses each year and can severely impact health and well-being. In July and August 2023, the University of Michigan National Poll on Healthy Aging asked a national sample of adults age 50–80 about their experiences with scams and their views on ways to protect against them.

Personal experiences with scams

Three in four adults age 50–80 (75%) reported that they experienced a scam attempt online or by phone, text, email, or mail in the past two years. Scam attempts were more frequently reported by men (78% vs. 73% women), those with a bachelor’s degree or higher (79% vs. 71% some college or less), and those who reported that their memory is fair or poor (83% vs. 74% with better memory).

Nearly two in five of those who reported a scam attempt (39%) said they experienced one or more of the following types of fraud: 25% had their credit card or bank account compromised, 15% had other accounts hacked, 9% had money stolen, and 3% had their identity stolen. Overall, 30% of all adults age 50–80 said they had experienced fraud.

Scams and health

Older adults who were more likely to report that they experienced fraud included those in fair or poor physical health (50% vs. 37% with better physical health) or fair or poor mental health (51% vs. 38% with better mental health), and those with a health problem or disability that limits daily activities (50% vs. 35% of those without such limitations). Individuals with annual household incomes under $60,000 were also more likely to report fraud victimization than those with household incomes of $60,000 or more (46% vs. 36%).

Among adults age 50–80 who had experienced fraud in the past two years, 75% said the experience had an impact (14% major impact, 61% minor impact) on their financial, physical, or mental well-being. Older adults who were more likely to report a major impact on their well-being included individuals with annual household incomes less than $60,000 (23% vs. 7% with incomes of $60,000 or more), those in fair or poor mental health (41% vs. 10% with better mental health), those with fair or poor memory (21% vs. 12% with better memory), those with a health problem or disability that limits daily activities (21% vs. 9% of those without such limitations), and those who live alone (24% vs. 10% living with others).

Recognizing scams

Fewer than half of all older adults (43%) said they were very confident in their ability to recognize scams, 52% were somewhat confident, and 5% were not very or not at all confident. Those more likely to report not being very confident in recognizing scams included women (63% vs. 49% of men), people with household incomes less than $60,000 (62% vs. 53% with incomes of $60,000 or more), and those with fair or poor physical health (65% vs. 55% with better physical health) or fair or poor mental health (72% vs. 55% with better mental health). Those who rated their memory as fair or poor were also more likely to report not being very confident in recognizing a scam (69% vs. 55% with better memory).

Protection from scams

Most older adults (83%) reported wanting to know more about how to protect themselves from scams. Those who reported not being very confident in their ability to recognize a scam were more likely to want more information compared with those who were very confident in their ability to recognize a scam (90% vs. 74%).

Nearly all adults age 50–80 (97%) agreed (52% strongly agreed, 45% agreed) that policymakers should do more to protect people from scams and expressed similar agreement that companies/organizations should do more (54% strongly agreed, 42% agreed). Older adults with annual household incomes less than $60,000 were more likely than those with household incomes of $60,000 or more to strongly agree that policymakers (59% vs. 48%) and companies/organizations (60% vs. 50%) should do more to protect people from scams.

Those who were very confident in their ability to recognize a scam were just as likely as those with less confidence to agree that policymakers and companies/organizations should do more to protect people. Older adults who did not report experiencing fraud in the past two years were as likely as those who experienced fraud to agree with the statement that policymakers should do more to protect people from scams.

Implications

These poll findings confirm that being the target of a scam is a common experience among older adults. Three in four adults age 50–80 reported being targeted by a scam, and three in ten experienced fraud.

This poll also suggests two important relationships between scams and health. First, older adults who reported having disabilities, poorer health, or poorer memory were more likely to report being the victim of a scam. Second, people from these groups were more likely to report that experiencing fraud had a major impact on their financial, physical, or mental well-being.

The vast majority of adults age 50–80 expressed interest in learning more about how to protect themselves from scams, and nearly all agreed that policymakers and companies/organizations should do more to protect people from scams.

There is an epidemic of fraud in the United States. While anyone of any age can become the victim of a scam, some scams specifically target older adults. Understanding who is more likely to experience a scam attempt or experience fraud can be helpful for tailoring outreach and educational efforts that can be critical to fraud prevention. Initiatives such as the Federal Trade Commission’s Pass It On campaign and AARP’s Fraud Watch Network focus on providing scam detection and prevention resources to help protect older adults. These initiatives also encourage the sharing of helpful information among family and friends.

Individuals who have experienced fraud should report it to their state consumer protection office or the Federal Trade Commission. Loss of money, possessions, or personal and other valuable information should be reported to the local police department.

Data Source and Methods

This National Poll on Healthy Aging report presents findings from a nationally representative household survey conducted exclusively by NORC at the University of Chicago for the University of Michigan’s Institute for Healthcare Policy and Innovation. National Poll on Healthy Aging surveys are conducted using NORC’s AmeriSpeak probability-based panel. This survey module was administered online and via phone from July 17th – August 7th 2023 to a randomly selected, stratified group of U.S. adults age 50–80 (n=2,657). The sample was subsequently weighted to reflect population figures from the U.S. Census Bureau. The completion rate was 50% among panel members contacted to participate. The margin of error is ±1 to 3 percentage points for questions asked of the full sample and higher among subgroups.

Findings from the National Poll on Healthy Aging do not represent the opinions of the University of Michigan. The University of Michigan reserves all rights over this material.

Read other National Poll on Healthy Aging reports and about the poll's Michigan findings, and learn about the poll methodology.

Citation

Solway E, Singer D, Box N, Kirch M, Roberts S, Smith E, Hutchens L, Kullgren J. Experiences with Scams Among Older Adults. University of Michigan National Poll on Healthy Aging. November 2023. Available at https://dx.doi.org/10.7302/21735